Summary: A core change to monetary policy could realign human economy with natural economy while massively simplifying the current system of burdensome environmental regulations. Under this new system, measures of economic growth track with environmental regeneration and measures of civic well-being.

The change to the monetary system that you will learn about in this chapter could also be a way to move us beyond the capitalism versus socialism debate. This new system—the terrametric monetary standard, otherwise known as regrowth economics—incorporates a lot of the good parts of capitalism, takes lessons from socialism, and fixes some basic flaws of both by performing a fundamental revaluation of value. Instead of doing what we do now—extracting wealth from wage labor and natural capital while externalizing environmental impact and pollution—the new monetary standard uses verifiable metrics of ecoregional fitness and regeneration to bring new wealth into the economy. Before we get into the details of how it would work let’s start with some basics.

The way that “wealth” is created in society today is in part through the fractional reserve banking system. New money is injected into the economy by central banks and when commercial banks make loans. Debt incurred today relies on a consistent rate of economic growth into the future in order to maintain the long-term system stability that comes from timely repayment of loans with interest. That growth is measured in ways that incentivise the consumption of material goods, the exploitation of natural materials, and the maximization of profit at the expense of labor, the environment, and long-range planning like timely re-investment in infrastructure before our bridges collapse.

The wealth generation system we have now was designed by humans and revised over time. Its centuries-old origins predate our shared understanding of the toll that consumer capitalism is taking on our planet. This is important to note, because it’s not helpful to dwell on blaming incumbent economic theories for why we have found ourselves in our current predicament. It’s much better to understand the systemic conditions under which they were developed and proactively design a path to a new system. When neoclassical and neoliberal economics came of age we hadn’t yet come to the gripping realization of their inherent unsustainability within the confines of a finite planet. And it’s understandable because the Earth is a very big place. 100 years ago the idea that we mere humans could ever impact the balance of the natural order was nearly unthinkable. Over the more recent decades we have come to realize (by finally listening to scientists) that overshooting the carrying capacity of the earth’s natural systems is bringing about catastrophic climate change, resource depletion, ecological systems collapse, and species extinction.

It’s clear we can’t go on this way. So what is to be done?

Some argue in favor of degrowth. Without question, the rate of economic growth that we set in motion in the 20th century cannot be repeated in the 21st. But how is this to be accomplished through democratic means within cultures that have been designed for so long to value consumption above all else? And how is this to be accomplished with a mind on social justice on a global scale? Can we deny economic growth to communities that were skipped over by oil-fueled 20th century prosperity?

And how do we all the sudden stop growing the economy when the economy is designed to require a larger economy in the future to cover the loans created today? Each new loan brings some amount of new money into existence (based on the reserve requirements of the bank). That is in large part what defines economic growth.

Well if we must continue to grow our money supply somehow, but our impact on nature can’t keep growing, then is there a way to decouple the growth of the money supply from the growth of planet-impacting consumption?

Yes there is. The world is ready for a better way to create wealth—one designed in symbiosis with natural systems.

First, let’s step back and review in more detail what the design brief looks like for this new system of money creation.

The manner in which we decide to forge new wealth and assign who gets to control it are social constructs; they are NOT laws of nature. We can change them.

However, in order to be accepted by society any new system of wealth creation must be designed in such a way so as evolve rationally from the old constructs (the narrative and the mechanisms must be easy to explain).

To be politically palatable, the new system must reliably increase the standard of living over time. New wealth must be put to productive use (productive both for human civilization and for the environment). It should not rely on a politically unstable construct of tax policy, which is seen by many as regressive or unjust. Taxing carbon may do some good at the margins, but the bulk of the tax will be paid by consumers in adjusted prices of goods, and then we must rely on governments to efficiently distribute the dividends in ways that strengthen social justice and environmental protections.

The new system must have the proper constraint mechanisms (like those that have evolved within central banks) to avoid runaway inflation.

On the list of environmental criteria, the new system should incorporate built-in feedback loops to support eco-regional regeneration and be designed to keep the rate of consumption within the limits of the earth’s ability to renew her natural resources.

It must be designed to be sustainable in perpetuity. Like nature, this new system of wealth generation is variable in its behavior based on circumstances. It learns over time based on vast amounts of real-time and historical data of how capital flows, and it naturally grows more diverse, resilient, and equitable over time. It must be resilient by design.

OK, now that we have established where we want to go, let’s take a closer look at where we are starting from.

What are the existing conditions—the business-as-usual case?

The system of wealth creation we have now was not designed at all to be sustainable or to incentivize resilience or equity. During the period in history when our current rules of banking and capital were designed, humans were not capable of planetary biophysical systems thinking as we understand it today. We had no idea about the limits of natural systems to regenerate and rebalance at a regional and global scale. The founders of modern-day capitalism assumed that mercantile relationships and the economies of scale and competition that Ricardo and Smith observed were somehow natural laws like those described by Newton, and that individual humans acting in rational self-interest would lead to a better world. Many today believe that “releasing the power of markets” is the best solution to any social problem. This worldview was made possible by a design frame that ignored (externalized) the exploitation of slave labor, colonization and genocide, gender inequality and the free labor of caregiving, massive environmental destruction, habitat loss, toxic pollution, extreme income and wealth inequality, and the myriad of social injustices that continue to this day in the name of maximization of shareholder value.

Humans are not naturally skilled at designing large and complex systems that are truly regenerative. We’ve never had to be because our aggregate environmental impacts have until recently existed within the carrying capacity of earth’s natural systems. This shortcoming was nothing to worry about until the industrial revolution, when the rest of the planet began to suffer for our shortcomings. Today we are starting to learn how to design regenerative systems, and we better do so quickly, because we are presently leaving a trail of environmental destruction and mass extinction so severe that its mark will live forever in the geological record—a thin vein of landfilled plastic and toxic waste.

But we can change change course with intention. By listening scientifically to nature, rediscovering lost technologies of indigeneity, and abandoning the old extractivist and dominionist engineering philosophies born from the first industrial revolution, we may soon be coming to a point where we can start to redesign our economic system as a symbiotic engine for the benefit of life on planet Earth.

Much has changed since the emergence of capitalism. The power brokers of the eighteenth century saw value in a system that was designed to promote cunning, self-interest, and ruthless competition within its incentive structures. At the time, survival of the fittest was the name of the game for individual daily life and for the wealth of empires.

Today we are beyond poststructuralism and metamodernism. We have reached a state of ecomodernism coupled with environmental and social justice. We are awakened to the interconnectedness of everything and the fragility of our pale blue dot of a home within the cold, vast universe. We possess a far greater self-awareness, vast amounts of data, sophisticated technology for analysis, machine learning, and an acute understanding of the impacts of our actions on the planet.

Capitalism and Materialism

In the 18th century, with the state of technology at the time and the seeming boundless nature of world resources, it made perfect sense to design an economic system that created wealth by using socially necessary labor time as the measure of value. It was something we could easily measure and agree on. Capitalism is a simple equation with only three variables: capital, labor, and wealth (c + L = W). For any enterprise, you could calculate how much new wealth will be generated in a given period by knowing how much capital (previously accumulated wealth or natural resources) was invested and adding to that how much labor time was spent on the production of goods or provision of services (person-hours).

Wealth is embodied in the services or goods that are produced by the enterprise and in the profit retained by the owners of the enterprise from the sale of those goods or services. Population is intrinsically tied to the creation of new wealth globally; as the variable L gets larger the more hands can be put to work.

With little care for the natural world, all of God’s creation is contained in the variable c and belongs to the person whose old wealth was able to purchase land (or support the army that took it) and extract resources from that land. Our economy is founded on dominionism, and its structure is designed to define success as dominion over nature.

Be fruitful, and multiply, and replenish the earth, and subdue it: and have dominion over the fish of the sea, and over the fowl of the air, and over every living thing that moveth upon the earth.

—God, King James Bible, Genesis 1:28

Capitalism is also designed to favor the incumbent power structure. Those who have excess capital are able to increase their wealth at an exponentially faster rate than those who pay rent and who work for a paycheck, a significant portion of which goes to pay off their debts. While the arc of the moral universe may tend towards social justice, it takes a really long time for this to happen under laissez-faire capitalism and it only can possibly happen because representative democracy enacts redistributive tax laws and social safety nets (wooden boat policies paddling upstream against capitalism’s swift and turbulent currents of plutocracy), and because government prosecutors and courts are there to uphold those laws which are made by the people. Under these social protections, knowledge and insight can break through the asymmetry of power and provide some social mobility. But the odds are not good, especially when higher education is out of reach, consumer financial protections are lax, one medical expense is enough to drive families to homelessness, and when our tax laws are woefully behind the sophistication and scale of contemporary personal fortunes, which continue to grow exponentially while the less fortunate half of society wants for basic needs.

While restrictions on capitalism’s more disastrous social consequences have been historically placed somewhat in check, the arc of the “moral” universe has shown over the past three hundred years that it does not tend at all towards environmental justice but rather quite the opposite.

At some level all the complex regulatory structures and social services mechanisms that place limits on the unfettered use of capital—whether to save the masses from abject poverty or to put some restraint on corporations from destroying the environment—are merely duct tape holding together a system that is incapable of producing good outcomes from its own built-in incentive structures. We can choose to continue putting band-aids on capitalism’s gaping wounds, or we can get in there and deal with the root causes of the problem.

We can write a new equation for capital.

What adds chaos and complexity to the old (current) equation of capitalism (c + L = W) is that—as the owner of an enterprise—technological innovations, increases in productivity, or asymmetric power advantages (access to cheap labor or cheap capital for example) can influence the variables in your favor. The following factors determine the absolute advantage you will have in the marketplace and the amount of wealth you can create for yourself:

- The more capital you have to begin with

- The greater your rational self-interest and your ability to satisfy it (selfishness and cunning)

- The stronger your influence on the rules (proximity to power)

- The greater your drive to compete (ambition)

- Your ability to reduce overhead, including holding down the wages and benefits you provide to your labor force

- Your ability to most efficiently extract natural materials at the fastest pace

- Your ability to externalize waste streams onto the environment

- Your ability to externalize risk onto the public sector

- Your skill for small, targeted, and highly publicised acts of philanthropy, greenwashing, and disinformation

This dynamic entrenches incumbent power structures and it incentivizes antisocial and ecocidal behavior by businesses. When market behavior tends toward illegal acts, those acts are policed in a classist and racist manner. We are shocked by images of individuals looting a storefront on the nightly news but we have no problem at all with the mass looting of social wealth by corporations engaged in wage theft, consumer fraud, political bribery, insider trading, stock buybacks, tax evasion, and offshoring.

On top of this, we tend in popular culture to worship the lottery winners of our free-market cagematch—the billionaires who made it to the top, especially those in technology sectors. We look to them to read the tea leaves of progress. We look to them for philanthropic largesse. We listen intently to their private sector solutions to the disasters we have brought on ourselves, forgetting that it was the previous looting of the public sector which filled their pockets with cash in the first place. We allow ourselves to be convinced by them to keep their taxes low. But the truth is that fortunes are serendipitous, nepotistic, and not based on a pure definition of meritocracy. Change a few variables or events in the past and we would be worshiping an entirely different set of billionaires with different names today. Extreme wealth is not a reflection of the worth, or merit, or even hard work of individuals, but is rather a reflection of an economic system that functions much like a casino, where some jackpots are there to be won by a few (the odds are slightly in your favor if you are white and male).

But before we get too down on capitalism, it does deserve some credit.

Putting to the side for a moment the litany of problems it has wrought on society, capitalism has produced a consistent rate of growth in per capita gross domestic product. Its proponents see an almost magical force (the invisible hand) that keeps growth to a trend line of approximately 2% on an annualized basis. The power of the invisible hand comes from the interplay between the competing interests of investors, consumers, and labor, wherein harm done to one of the three limits the benefits to the other two. When operating with access to fossil fuel energy, cheap labor, and seemingly limitless natural resources, this dynamic establishes a win-win-win scenario under ideal conditions for a certain class of people. Capitalism creates efficiencies through division of labor and the complex, interconnected feedback loops of information that flow through futures trading markets (when they are not being manipulated). Capitalism, fueled by coal, gas, and petroleum energy, is the reason that our average life expectancy is longer, scientific progress has flourished, and quality of life is greater than it was 300 years ago for the majority of people in the global north.

A consistent growth rate of 2% is a trend that amounts to a doubling every 35 years. In nature such a growth rate would soon hit a limitation. We see this pattern in viruses for example. Eventually their logistic curve flattens when they have infected all of the potential hosts or some other measures are taken to reduce their growth rate. Could the capitalism equation be hitting such a top limit as we approach the middle of the 21st century due to limits on natural resources, limits on the ability of the Earth to absorb our pollution, and limits to marginal improvements in worker productivity that are possible through technical innovation?

What do we value?

In the early twenty-first century we are beginning to witness the natural limitations on the creation of new social wealth using the capitalist system of value. Automation threatens to wreak havoc on the balance as the L in the equation is increasingly accomplished using “dead-labor” (e.g. computers, robotic automation, artificial intelligence, etc.) rather than “living labor” (that provided by a human) and there are consequences from this on unemployment and wages.

Mariana Mazzucato dissects the idea of value from mercantilism through contemporary capitalism (neoclassical economics) in her 2019 book The Value of Everything. She argues that we have stumbled into a system that disconnects the value of goods and services produced within our economy in relation to their value to us as individuals and as a collective society. This is a consequence of using price as a determinant of value as it reveals itself on the supply and demand curve. This is a subjective measure of value that is not rooted in things in the world and gives rise to the odd situations under capitalism wherein gross domestic product goes down if someone marries their caregiver (the caregiver used to charge a price for the service and no longer does so, but the service is still provided nonetheless), or GDP goes up if a company spills toxic waste into a river because there is a price associated with cleaning it up. There is no built-in mechanism in our current economic system for reflecting the value of environmental conservation, volunteerism, uncompensated creative work, or caregiving. Essential services and government services are undervalued in their price and consequently in the remuneration to those who provide them. This is all done by way of the mechanism of rational choice.

As industry continues to grow, production keeps increasing, consumer demand stays strong, and as each generation demands yet higher standards of living, we will continue to bring about the next doubling of natural resource extraction and the next doubling of pollution, and the next, until natural limits start to create instability in climate systems, mass extinctions, and threaten massive disruption to human civilization. In fact this is already underway.

At some point we hit the limit on the available natural resources that are required to keep the variable c (capital) growing in proportion to the economy (population × per capita consumption). At some point we hit the limit on the amount of microplastics, nitrogen, phosphorus, CO2, pesticide, and fracking fluid that we can pump into the natural world without fundamentally altering the balance of earth’s life systems and bringing on a kind of sepsis of the planet.

Soon we may be ready to make the massive public investment required for the clean energy transition, but we must first set the ground rules so that we use our wealth wisely to make the necessary investments in regenerative infrastructures to mitigate the impact of our civilization on the planet.

We don’t have time to terraform Mars.

If we do nothing and let free-market capitalism play out with the rules as they are, we risk witnessing a dystopian descent from growth and prosperity into contraction and forced scarcity as Earth’s systems react to the greenhouse effect, as critical habitats are destroyed, and as we consume the last of earth’s natural resources with abandon.

There are some who tap into their childhood imagination and talk of humanity leaving Earth behind on a mission that continues our colonial-capitalist imperialism to extract resources from distant planets, meteors, comets, and solar systems. That future may come to pass eventually, but for now we must be thinking about the next 30 years not the next 300 years, or that potential future will cease to be possible (civilization will be forced by nature through a major, disorderly, and traumatic contraction). We must first get the equation for capital into systemic balance here on planet Earth.

The good news is that we don’t have to sit idly by and watch the third act of 18th century capitalism (feat. mass extinction, flooded coastal cities, mass migrations, water wars, pandemics, crop failures, and deadly heat waves). We can instead shift the way we define value and create wealth. We can design a new economy to bring about an end of scarcity, an age of abundance in harmony with nature.

Regrowth Economics is a new alternative to capitalism and socialism. It incorporates a lot of the good parts of capitalism and fixes some things by performing a fundamental revaluation of value. Instead of using wage labor to generate new wealth, regrowth economics uses a healing planet to generate new wealth. It measures that healing through terrametrics.

Defining Terrametrics

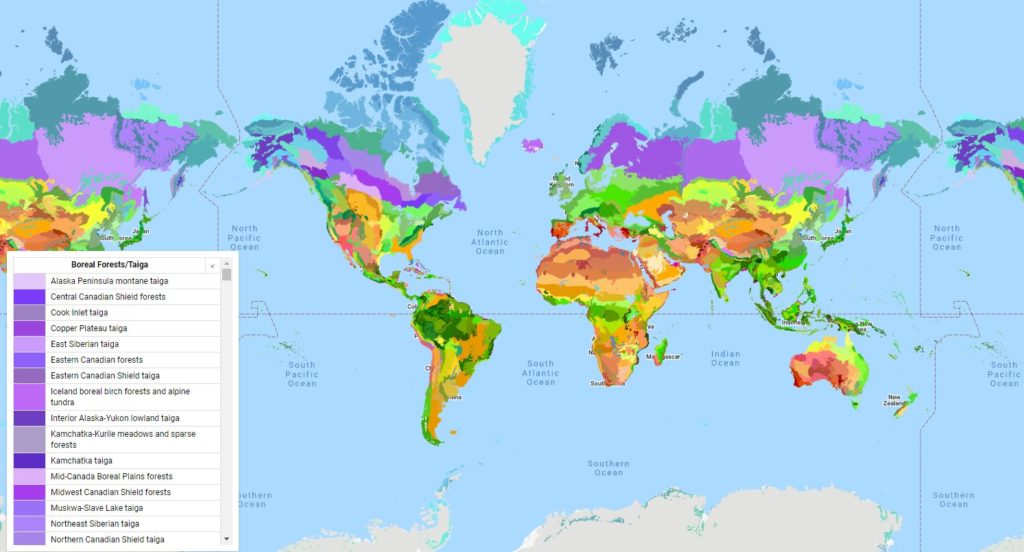

We begin by mapping the Earth’s ecoregions. They are Mother Nature’s own political boundaries that evolved around watersheds and topography. Their borders are extremely porous and can be considered more of a gradient, with a boundary layer where both ecoregions coexist together. This work of ecoregional definition has been perfected over the years by a number of organizations. The header of this chapter is an image of the Earth’s ecoregions courtesy of Resolve, a non-governmental organization dedicated to environmental and health mediation.

These natural regions are porous because there is communication of information between them. This is an important feature because all of nature has evolved around the use of information. Trees that can listen to the mycelial network—the underground communications infrastructure of the mushroom world—have advanced warning to prepare for a coming pestilence over those that cannot.

The natural world is communicating to us all of the time. Through our senses, yes, but today our senses are enhanced with technology to the point where we can gather real-time data on the health of ecosystems by using a web of geosynchronous satellites and remote self-powered land-based monitoring equipment.

At the same time as we are coming to grips with the wrath that our unsustainable use of natural resources has wrought us, we are also coming of age as the masters of the kind of technology that can allow us to listen to the biofeedback loops of the planet as if from a God-like perspective. We can see the Earth breathe through the natural carbon cycle, we can track point source emissions, we can watch CO2 concentrations in real time, and we can even begin to listen to the chemical communications of insects and plants.

Satellite images can be used to determine the moisture content and other qualities of soils, biodiversity, impacts of invasive species, ground and water pollution, air quality, desertification or reforestation, and habitat degeneration or regeneration. Persistent change algorithms use machine learning to notice that a certain square meter area of the planet has gone from paved to unpaved or vice versa. A great example of these kinds of systems in action is the Global Ecosystem Dynamics Investigation research that uses precise 3-D measurements of Earth’s vegetation to provide detailed forest carbon data.

Similarly, social sciences around civic engagement, and polling have become sophisticated enough to provide reliable data through large field surveys and meta-analysis. We can see the gini coefficient rise or fall each year.

Using these tools that have been developed and improved over the past few decades, a new kind of economic system can be designed—one that is based on the monitored health of the earth’s ecoregions and the health of our social fabric and our civic engagement. The monitoring equipment that will allow us to listen to nature will be land and space based. The empirical data used to measure civic engagement and wellbeing will be obtained from voting patterns, the Bureau of Economic Analysis, field surveys using the apparatus of the census, and through a vast interconnected network of social service providers.

To ensure checks and balances against corrupt action the measurement systems will be designed in triplicate and overseen by three separate agencies. The first agency is the federal government, and eventually a consortium of governments, the United Nations. The second agency is a consortium of businesses, headed by the Chamber of Commerce (eventually the ICC) and a body of private sector environmental monitoring and geospatial intelligence companies. The third is the academy, headed by a consortium of universities.

A new system for detailed biofeedback detection will be designed and built by the three independent governing organizations, each in charge of fabricating and maintaining the system to the agreed upon performance specifications, and each is subject to regular testing and balancing. Each is responsible for providing raw data to the other two in real-time.

New wealth is inserted into the global economy (we’ll discuss below how this happens) when an ecoregion’s key performance indicators improve by a milestone interval. Each interval will be set rather low, but not so low as to pick up noise in the signal being communicated by nature and society. The evaluation and balancing of these terrametric milestones can be done regularly as a countervailing force against market fluctuations.

The terrametric standard is based on real-time monitoring of the following earth and civic system performance indicators (terrametrics):

- Global System Measures (wealth is distributed to all people equally as these improve)

- Percent reduction in anthropogenic emissions of CO2

- Percent reduction in mercury, Sulfur dioxide, Nitrogen oxides (NOx), and soot

- Percent reduction in anthropogenic emissions of methane, Nitrous oxide (N2O), and tropospheric ozone

- Percent change in anthropogenic emissions of CHC, HCFC, HFC, Halon, Sulfur hexafluoride, and Carbon tetrachloride

- Percent change in prevalence of plastics/microplastics in earth/water systems

- Percent change in ocean habitat regeneration (ocean biomass)

- Percent change in marine life and biodiversity in international waters

- Tons of CO2 removed from the atmosphere through direct air capture divided by tons of CO2 emitted in the same year

- Tons of CO2 removed from the atmosphere through bio-sequestration (new thriving forest and improved agricultural practice) divided by tons of CO2 emitted in the same year

- Ecoregional System Measures (wealth is distributed to all humans equally within the bioregion as these improve)

- Biodiversity

- Biomass density (forestation vs desertification)

- Percent old growth forest and conserved land area

- Change in percent land area without development (calculated down to the shrubs in your backyard)

- Reduction in local stormwater and groundwater contamination

- Improvement in local air quality

- Efficiency of land use

- Reduction in nitrogen and phosphorus runoff

- Soil fertility

- Renewable energy landscapes

- Reclamation of extractive landscapes

- Levels of pollutants in drinking water supplies

- Regional Civic Wellbeing and Progress

- Percent change in population who engage in civic activity, including voting, volunteering, and public service

- Percent change in access to public health and education

- Percent change in Genuine Progress Indicator

In the beginning, small acts of verified remediation and incremental improvement are worth a great deal. Much like the relationship between interest and principal on a mortgage, over time the marginal value of remediative acts falls on an asymptotic relationship to zero where we effectively reach a steady state with nature, achieving the goal of degrowth towards a steady economy that will ensure sustainable human civilization for a thousand generations to come.

We know technically how to do this work to regenerate the environment. Organizations like Commonland have been regenerating large land areas over 20 year time horizons with a science-based framework and with measurable outcomes. Groups like Ecosystem Restoration Camps are demonstrating the practical methods to bring about this kind of transformation.

The Act of Revaluation

Let’s look at the mechanisms behind the creation of money under our current economic system. A central bank—in the case of the United States the Federal Reserve—regulates the supply of money in the economy through monetary policies, which are consistently updated based on new information from the market, the government, and banks. This is a modern phenomenon. Money supply used to be regulated solely through the printing of coin and paper currency, which passed initially through the government or preferred private banks. At various points in time paper money was backed dollar-for-dollar by gold reserves. The gold standard was abandoned for many reasons, including the fact that consumer prices could fluctuate rapidly upon new gold discoveries or exports and because there was a propensity for periodic bank runs. Under a gold standard monetary system, the only real way to create new money was to secure more gold reserves. Interestingly, it was an agricultural economist, George Warren, who influenced President Franklin Roosevelt to effectively end the gold standard by devaluing the dollar, despite the fact that Warren was considered a crackpot by the many respected economists of the day.

To create new money today, the Federal Reserve simply adds equal amounts to its assets column and to its liabilities column. This has the effect of increasing the amount of money available to banks at the Fed’s discount rate of interest, which it can raise or lower to influence the flow of new money into the economy. The Fed can also buy Treasury bonds from the government or purchase troubled assets from private markets (quantitative easing) to inject capital and liquidity into the system. The Fed can modify the reserve ratio requirement, or the amount of cash on-hand that banks must maintain in relation to the amount of loans they have outstanding.

Under regrowth monetary policy, the value of the dollar (or for an international version, the SDR could be used in the same way) is set in standard against the terrametric wellbeing of the earth’s natural systems. The details of this valuation (the weighted value of each terrametric and the definition of new terrametrics over time) are subject to change by congress and are a reflection of the will of the people and what we value collectively as a society. The central bank will have limited control over an emergency multiplier and will maintain most of its standard suite of monetary policy tools such as short term rates, but the details of their statutory mandate will change in response to the new system.

In our existing economy, loans are dispensed—first by the Fed and then by private banks—not just on the faith that the individual borrower will pay back the principle and interest, but also, in aggregate, on the faith that the entire economy will generate wealth at a rate sufficient to cover the cost of the compound interest over the life of all loans. This is generally true because as population increases and additional capital enters the market through loans, productivity increases, population goes up, innovation occurs, and consumer spending and gross domestic product (GDP) also increases.

Our current measures of economic growth are unfortunately not aligned with the sustainable stewardship of the environment. GDP goes up for example when a toxic spill in the ocean requires massive investment in a cleanup effort and the replacement of damaged infrastructures. The toxic spill perversely adds “value” to our collective “wealth.”

In the new terrametric economy, loans are given out on the faith and trust that commensurate environmental regeneration will take place over the life of the loan, thus allowing the new biometric wealth creation to expand the money supply in a manner that is on balance equivalent to the cost of the compound interest over the life of the loans.

In the existing economy, when the Federal Reserve places new money onto its balance sheets, there is a multiplier effect in the economy. The fractional reserve banking system allows banks to lend out far more money than they have on their balance sheets. The net result is that for every dollar created by the Fed, there is an additional nine dollars available in the economy from lending institutions (with a reserve ratio of 10%). Eventually, through the deposit multiplier effect, the amount of money is further increased. And again through the magic of complex tiered financial instruments like derivatives, the amount of money in the economy can be orders of magnitude greater. In the purest version of regrowth economics that will be reached at some point in the future,, the reserve ratio would be set at 100% (a deposit multiplier of nearly zero), meaning that the amount of loans is limited to the amount of new wealth that is generated through terrametric performance measurements.

At first there should be no problem with this change because we will set the value of the terrametrics to align with the amount of total wealth that the economy generates currently. In effect we are frontloading and guaranteeing new wealth creation as long as environmental and civic regenerative acts are performed. Over time, this requirement will eventually have the effect of realigning the real economy to the carrying capacity of nature, as the terrametrics experience less year-on-year change when the natural systems of the earth are restored to balance. We have a long way to go before that will happen, but when we do it will mean that we have entered into a sustainable steady-state economy that progresses within natural limits.

The transition to terrametrism can be made nationally or internationally. For the sake of argument I am assuming an American economic transition to the new system that would eventually be implemented in other countries in a way that is similar to the devaluation from gold rolled out nation by nation in the 1930s and 40s. With the dollar as the world’s reserve currency, this shift in the United States would likely be rapidly adopted by other central banks. As mentioned above the International Monetary Fund (IMF) uses its own reserve currency called Special Drawing Rights (SDR). Presently the value of the SDR is calculated from a basket of international currencies that each are assigned a weight. This is completely arbitrary and could be replaced by a terrametric standard.

According to the Global Wealth Report 2019 by Credit Suisse, per capita global wealth has increased recently by about $1,300 every year, although this is wildly unequally shared. In the US, per capita wealth creation is around $10,000 per person. This accounts for all of the new money that has been created in the system through the actions of the central bank and the multiplier effects of all lending. Under terrametrism, in order to establish a seamless transition, a commensurate amount of new wealth—$10,000 USD per person per year—will be generated through acts of environmental and civic stewardship and will be distributed equally within ecoregions. In other words, the sum total of all the observable terrametric measurements (CO2 emissions, biodiversity measures, etc.) will be established so that on an annual basis they equal $10,000 x population. In the case of the United States in 2020, this would be $3.28 trillion. An example of what an annual calculation might be like can be seen in the form below and in this excel file.

While you have fun playing with the numbers, remember that the $10,000 per capita will be the average over the entire nation. Within the ecoregional and civic engagement categories, some ecoregions will do better than others on certain measures. Some will lag behind. The result is that an ecoregion that is the greatest steward of nature will find the greatest wealth for its inhabitants. In the ecoregions of greatest stewardship, individual dividends may be twice as large as those in other ecoregions. This idea of healthy competition towards incentivizing regenerative activity that gets more efficient and innovates is a key feature of capitalism that drives the new terrametric system. In this case, however, the incentives are aligned with the planet.

This wealth creation will occur in real time as remote data is monitored and analyzed, similarly to how wealth creation occurs in real time through the fractional reserve banking system today as credit is approved.

In the system we have today, the details of wealth creation are opaque to the public, whereas under terrametrism the distribution of new wealth will be made directly to terrametric individual dividend (TID) accounts held securely by every person. Because the nation is able to follow along each day with the latest reporting within an online public dashboard, individual and coordinated group actions are capable of responding by reasserting conservation/regeneration efforts in the event that wealth creation appears to be slowing. In effect we are gamifying the healing of the planet. Everyone can watch as their annual wealth dips below $10,000 per capita and can redouble their collective efforts to improve the terrametrics in their region.

Newly created wealth moves from individuals up into the financial system rather than wealth trickling down to the people from the banks. It is designed to create a virtuous cycle—the more we do things that are good for the planet and human society, the more wealth we create for ourselves.

Under terrametrism, the people are empowered with initial capital and so the entire concept of unemployment is transformed. Any individual not engaged in some professional, official, or artful activity can take it upon themselves to spend the day on regenerative acts that contribute to social wealth creation, or they can join an organization coordinating such acts. They may decide to seek employment in the traditional sense in order to provide a living income for their family, but if they are unable to find it for any reason, their TID account acts for them as a $10,000 floor (think of it as a universal basic income) against the effects of deep or extreme poverty.

As new wealth is created, the $10,000 per year per person adds to the savings of individuals. It is provided to them in addition to their salary and other earnings, and they may do with it whatever they want. They can invest it in business ventures, invest it in government bonds, or simply let it accrue. While it remains safely in the TID account it also serves as handy capital mechanism for the central bank to keep everything in balance and provides capital liquidity to the economy. Many people choose to keep some balance in their TID account as an act of terrametric patriotism.

Wealth is evenly distributed to individuals regardless of age.

The TID accounts of minors may not depleted or shifted by their guardians and so when a person reaches the age of maturity (let’s say eighteen) they have $180,000 to begin their life. While funds remain in the TID account they do not accrue interest. But individuals can band together into cooperative banks, able to dispense loans (create new debt) that are no greater than the sum of their TID accounts. Individuals can also decide to pool their TID account with an existing financial institution to add to its ability to originate loans. TID accounts of minors will remain within the purview of the National Investment Authority.

The primary TID administrator would be something akin to the National Investment Authority proposed by Dr. Saule Omarova at Cornell Law School—a kind of public version of a private equity fund that would finance major infrastructure projects (e.g. renewable energy installations) free from the market constraints of rapid return on investment. In this way, the collective wealth of the people that is derived directly from terrametric health of the planet is harnessed to the benefit of future generations of humans.

This change will have the effect of shifting the US Dollar from a fiat currency to a standard currency wherein that standard is terrametric wellbeing (rather than gold as is used to be). New wealth will no longer be manifested by the fractional reserve banking system. Banks will still make loans to borrowers just as they do today, except that the amount they hold in reserve (reserve requirement or ratio) must equal the difference between the aggregate loan amounts and their terrametric dividends. In other words, individual savings derived from ecoregional regeneration (terrametric dividends) form a stabilizing backstop to the financial system that keeps it from becoming overly leveraged.

The most important result of the new incentive structures is that wage labor is no longer the thing that creates value in the economy. This ties in nicely to the fact that artificial intelligence is expected to reduce the need of businesses to hire humans for tasks that were previously deemed un-automatable. Rather than create yet another artificial layer called universal basic income (UBI) onto an already broken economic system, terrametrism works this feature into the heart of the new system.

Wages still exists under terrametrism. Many people will be interested in seeking income beyond the $10,000 they receive each year from the wealth created by regenerative acts. Society will still be structured around corporations and local governments and all of the institutions that make our cities so vibrant. Innovation will still take place under the same motivators as before. Income inequality will still exist, but it will be moderated within a much narrower limit. Prices will still be established by the market, but the market will be transformed in how it places value on goods and services by the fact that new wealth emerges from within each person and only insomuch as there are regenerative activities to create it. Because wealth emerges within accounts of individuals, the power that the financial sector has over the distribution of wealth is reduced to the benefit of the people. Wealth will trickle up to the banks rather than down to the masses.

Natural capital, ecoregional wealth, ecosystem services, landscape function, and civic engagement each defined by measures of thriving become the revaluation of value for all of human civilization that undergirds the global economy with built-in incentives to invest human time and capital in useful stewardship in support of undisturbed wildlife, biodiversity, habitat restoration, greenhouse gas reductions in air and ocean, fewer landfills, reduced pesticide and herbicide use, fewer microplastics, reductions to anthropogenic airborne and waterborne particulates, healthier more resilient forests and marine ecosystems, and all of the other metrics that scientists tell us have been thrown out of balance since the dawn of the industrial revolution.

When new value is created within an ecoregion, the currency that is tied to that value is automatically distributed equally to every registered resident of that ecoregion. By their nature, ecoregions tend to cover areas that include urban and rural landscapes. Also, the amount of improvement that is possible in urban areas is greater. For these two reasons the distribution of new wealth will not disproportionately go to those who live in rural areas.

Eventually indicators such as parts-per-million of CO2, ozone levels, and ocean acidification that cross ecoregions will accrue value that is evenly distributed to every person in the world.

This will not be a cryptocurrency, because it will not rely on a blockchain, but rather the distribution of the new currency into circulation will be administered by the National Investment Authority and governed by the three independent governing organizations with full transparency and publicly-available real time verification in triplicate based on raw data collected in the field and from space. These systems can run on blockchain technology. Foreign currencies, cryptocurrencies, and commodity futures will establish exchange rates against the value of the new terrametric US dollar. That said, this idea of terrametric wealth could be applied to a cryptocurrency in the event that one becomes the reserve currency of a major economy. In other words, terrametric wealth generation is not incompatible with cryptocurrency.

The three governing organizations will be accountable to their stakeholders: to the people through their representatives, to the business owners, and to researchers and teachers through their universities, and they will audit each other in an open process that includes public reporting and open records. Each will publicly display their data on a web-based platform for real-time monitoring and public verification that pinpoints exactly the location where the improvement was observed, its value, and the population to which its wealth was distributed.

Agency and Authenticity

The people in this new economic system are not passive actors, sitting idly by and waiting for nature to heal herself and gift them wealth. You can earn wealth for yourself and your ecoregion by planting a tree in your backyard and nurturing it beyond establishment. Spending a weekend removing invasive species from a city park will generate wealth for your ecoregion in addition to the benefits that come from the physical exercise. If you invent an efficient process of removing microplastics from the ocean, the wealth that your intellectual property is capable of generating could be enormous. The system is designed to encourage innovation and entrepreneurship in this way and the American dream of striking it rich will become even more attainable to anyone.

Global wealth will increase over time as CO2 emissions are reduced. The value placed upon each terrametric will determine the amount of wealth generated by its improvement interval. The assessment of what measures are the most important to preserving natural balance will be established at the beginning prior to monetary revaluation and can be modified with the agreement of all three governing bodies. CO2 emissions reductions may, for example, generate significant wealth for everyone in the world as the value of each interval will be set rather high—a reflection of the importance of this one terrametric.

Areas of human development will naturally coalesce into interconnected nodes without sprawl that allow for the greatest contiguous areas of undisturbed nature. This is because eventually there are limits to the actions humans can take to regenerate virgin land. Once the marginal benefit of human intervention has passed for an area of land it is best left to its wild devices in order to generate the most environmental wealth.

Wealth can be lost, not only created. National debt is generated when any terrametric goes negative over a measuring period. Should metric tons of carbon increase or measures of microplastics go up in the ocean, wealth will be taken back from the ledger and investments in social infrastructures will slow down. Individuals will see their TID savings depleted in the same way those with 401K portfolios see their savings depleted when the stock market drops today. The remedy is simple and managed quarterly by congress. Simply accomplish more regeneration and maintain a total wealth dividend that does not induce demand-pull inflation.

Measuring Terrametrics

Key performance indicators will be tracked in relation to pre-industrial levels. An asymptotic relationship will be established between the relative measure of additional wealth and the interval improvements in the system. After 200 years of the new economy, when much of the damage done by humankind that can be repaired has been repaired (we will never be able to bring back the millions of extinct species), the incremental changes will become smaller and the value of each will become greater. This asymptotic relationship to wealth and the environment will ensure that we can effectively reach a steady state of habitation where the number of planet Earths we require can reach and remain sustainably at 1.0. This transition can be fine tuned by the deposit multiplier that is established for central banks. As this number moves from where it is today (around 80%) to less than 1%, the terrametric standard has an increasingly greater regulatory role on new wealth creation. At the point where we have reached a steady state and an Earth system in balance, even the smallest gesture of measurable environmental regeneration will generate an enormous amount of wealth for an ecoregion’s human stewards.

Today our environmental footprint is at 1.75 Earths and we are trending towards 2.0 Earths by the year 2030. Estimates are that the Earth can safely carry 1.5 billion people who have the consumption patterns of the average American, and we are soon to exceed 8 billion people. This means we would need 5 1/3 Earths if the world all lived an average US lifestyle. Obviously, we only have the one Earth, so if we are consuming it at twice or five times its natural rate of regeneration, we will eventually reach a tipping point. It could come soon, or it may take a couple more generations, but science tells us clearly that it is around the corner. It is therefore imperative that we undergo an intentional revaluation of value.

Capitalism extracts value from human labor. It defines the value of our social wealth in relation to the time we expend to forward the means of material production and consumption. Time spent engaged in other activities, such as planting trees and fixing things at home (so we don’t need to buy a new appliance)—this time does not have value under capitalism. Capitalism may be a great system for the exchange of goods and services, but its original sin is how it chose to define value.

With terrametric measurements as the new valuation of value, the incentive structures built into capitalism will naturally re-balance in favor of regenerative activities.

What is a regenerative activity? We can define this as any labor time or capital given towards the design and implementation of a system that improves the performance of any of the terrametric indicators listed above. Some examples include:

- Renewable energy installations that demonstrate a replacement of fossil fuel energy demand over their useful life

- Reforestation beyond an establishment period and not requiring irrigation

- Direct air capture that provides a net reduction of CO2 concentrations

- Participation in democracy

- Participation in social maintenance activity (volunteering for example)

- Bringing new life to dead coral reefs

- Preventing uncontrolled wildfires

- Forest conservation

- Energy efficiency measures

- Improving biological diversity by reintroducing native species into an existing monoculture

- Cleaning waterways

- Improving the stability of keystone species

- Displaced consumption (through a culture of stewardship)

Actions that require the unnatural geoengineering of earth’s natural systems would not qualify. Examples of these include:

- Injecting the atmosphere with sulphur dioxide or some other light reflecting particle or aerosol

While this may have a temporary effect of lowering average global temperature while injection is regularly maintained, if the injection is stopped for any reason and real CO2 PPM is unchanged, the rapid swing back could be catastrophic. In the meantime it could have unforeseen impacts on weather patterns, bringing new droughts to some areas while flooding others. - Attempting to slow the rate of glacial melt through local artificial means such as insulating blankets or artificial snow

- Space-based infrastructures

Climate science has progressed well enough over the past few decades, and the technical solutions that would have the greatest impact with limited unintended consequences have been well enough identified and vetted with scientists, that the suite of tools to be included in the valuation can be studied, verified, and modeled prior to implementation.

By forcing congress to set variables of economic growth that naturally lead to regenerative economic activities, the nation will have a reckoning with the trajectory we are presently on, and work together to set a new course.

Consensus

Revaluing value in a way that will radically transform our economic system will not be an easy sell within the American polity.

Recognizing this, there is a built-in concession in the new system to the libertarian conservative. If it would ever be possible to pass legislation in congress to enact terrametrism in the United States it might be because of a coalition of libertarian Republicans and the majority of Democrats. The conceit to libertarianism is that terrametrism greatly increases the level of individual freedom by dispersing wealth in its first instance to individuals rather than to central banks. The role of government under terrametrism may be reduced since we no longer require a patchwork of regulations and “mission-guided” investment from the government and wealthy individual who pick winners and losers in the market each day in a Sisyphean effort to protect social and environmental health. No more will well-intentioned environmental regulations like NEPA be weaponized to slow or stop projects that have positive environmental impacts. Instead, the incentive structure to put our labor to valuable social and environmental purposes is built into the monetary system at the root level. The moral mission is defined upfront by representative democracy by adjusting just a few key variables and then unleashing the power of the market to make it happen. Much of the new wealth that is created through regenerative acts will be accomplished by the private sector, which can take action at scale, harnessing the capital of the people for good.

The United States was founded on enlightenment ideals of human rights, equality, justice, and freedom. The economic system it adopted has been a hindrance to the delivery on the promises of the Declaration of Independence and the Preamble to the Constitution because it is a reflection of a pre-enlightenment human culture that valued power and dominion over empathy and stewardship.

Let’s stop explaining, stop mourning, stop scaring, stop shaming, and stop freaking each other out. Let’s instead work together to design a new economic system that can provide the incentive structures we need for the stewardship of a habitable planet for humans and all life on earth.

Salvador

Very interesting. Let’s do it…

I should rely more in groups in the community than in governmental structures.