Top left of each diagram is the after-tax income of the wealthiest household.

Bottom right is the after tax income of the poorest household.

The simple curve tax is a modest proposal to reduce income inequality in America. Later we will look into the potential implementation of a more radical approach, a meritocratic maximum wage, which could bring even greater benefits and I argue would be even more compatible with terrametrism.

The simple curve tax begins by assuming the income tax will continue to function exactly as it functions today, but with modified brackets and rates. It asks and answers the question, “what would the ideal income tax code look like?”

The new income tax system should do a good job of maintaining incentives to innovate and start new enterprises. We don’t want to take away the carrot of striking it rich in America. While this notion has been shown to be somewhat of a myth in recent years (abused by neoliberal pundits to argue for flat taxes and trickle down economics), I believe we must maintain the carrot of prosperity in a responsible way that reinvests in the future, narrows the wealth gap, and provides equal opportunity to all. In this way we can harness the force for good that markets can bring, while reigning in the excesses that tend to keep markets from attaining their true potential.

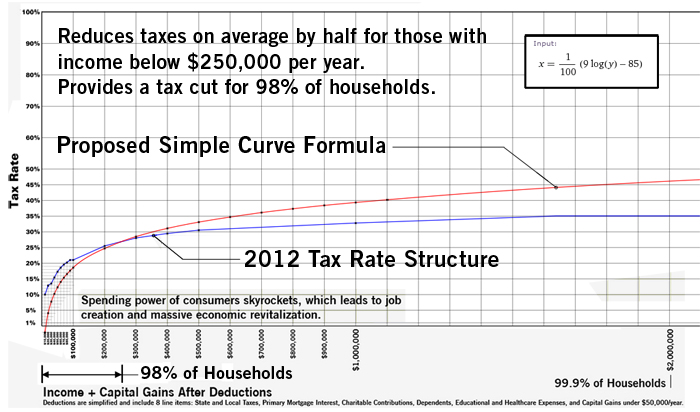

What if there was a way to cut taxes for 98% of households while revenue from income taxes is increased by 15% for public investment? I’m looking for a simple tax that I can send in on a postcard-size piece of paper—one for which the entire tax code could be reduced to just a few pages, but which would be progressive and help to reduce income inequality while providing the free-market economy with a stimulus shot like nothing it’s seen before. It will have simple deductions and one formula that does away with all of the IRS forms and schedules.

The flat tax is a formula: tax rate = .2 (Income). But I think that is kind of dumb. For one thing, it would raise taxes on everyone with income below $80,000, while lowering taxes on everyone making more than that. I think instead that it is the households making less than $80,000 who can use the money most and that it is their consumer power and savings rate that drives the economy forward.

Instead of a flat tax, I propose the following formula be permanently substituted for the current income tax system:

tax rate = (9*log(“taxable income”)-85)/100

The log is a natural logarithm. If you want to place it into excel, you would use: tax rate=(9*LN(income)-85)/100. No one has to do the math themselves of course. The IRS will have an online calculator that will do it for them.

Amounts owed less than $500 are forgiven so you won’t see federal income tax until about $18,309.00 in taxable income.

There are still deductions and a few exemptions, but they are very simple.

Capital gains are tax free up to $50,000, and then taxed at as normal income above that.

You can deduct up to $50,000 in mortgage interest paid per year on your primary residence. $50,000 is equal to the first twelve months of interest paid on a $1,250,000 mortgage. Everyone with mortgages less than that will fully benefit from the deduction. These deductions provide a nice incentive for investment and the wise use of capital, but placing a healthy limit on the credit will help address the serious issue of wealth inequality.

Below is a sample online calculator. You can’t place a “$0” as the salary (the calculator is not that sophisticated). To see what someone without a salary would see, put in “$1,000.”

For those who are interested in the amount of revenue that the Smooth Curve tax will generate, I’ve done a calculation based on the number of households at each income bracket. It turns out that the Smooth Curve tax actually increases the revenue that the government collects from income taxes by 15%, netting about $1.9 trillion bonus each year (not counting additional capital gains revenue).

That makes sense! Now we can start to be fiscally responsible, invest in infrastructure for the 21st century (how about a 100% post carbon economy!), provide excellent public services, free education, give the vast majority of Americans more money in their pocket, and enhance all of the social benefits that create a healthy society and a powerful economy.

Classical liberal economists will argue that the additional revenue will not come to pass because the economy will not grow as quickly as it would if we provide greater incentives to the “risk takers,” but there is no empirical evidence to back up that theory. In fact, what evidence I can find points in the entirely opposite direction. Just from the common sense perspective it only stands to reason that economic activity will increase when a greater percentage of the population moves from a situation of having zero savings and zero discretionary income each month to a situation of having some amount of discretionary income that can be spent on purchases.

Below $13,300, the equation produces a negative rate. That means that those households would receive a check from the IRS based on some formula. That payment is small and not intended to replace any social programs, which should all remain in effect, unless replaced with something better.

An example of what something better could look like can be found in the next chapter. It is a more radical approach to social revenue that turns the table on how taxes work, and proposes a new way of thinking about the idea of meritocracy.

True Equality of Opportunity: Rediscovering American Meritocracy - The Greatest Economy is Equitable and Sustainable

[…] If the solution presented here is too strong for your taste, you may be more interested in the Simple Curve Tax proposal as an alternative. It maintains the system generally as is, and instead increases the […]